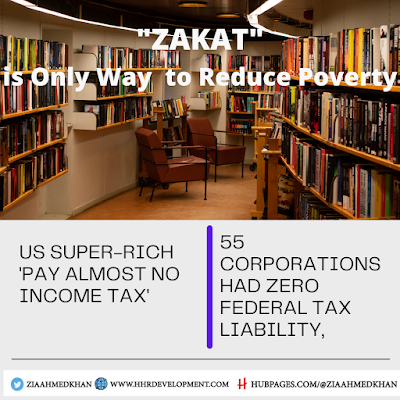

When Government Pay for Rich, Poor get Poorer

- This is called capitalism

U.S. poverty totals hit a 50-year high

The government’s efforts to save the banks is

basically paying poor people's money ( stealing and extorting) and giving it to

rich to enjoy life. The whole exercise of QE1 and QE2 are just efforts in

saving the funding lobbies and their interest so that they can get funding for

next elections.

All these easing has made life more difficult

for the poor. It has made basic staple food affordability not only in poor

countries but also in USA. More than 15% are poor who can have healthcare,

housing and education.

Soaring Poverty Casts Spotlight on 'Lost

Decade'

Reporting from Washington—

In a grim portrait of a nation in economic

turmoil, the government reported that the number of people living in poverty

last year surged to 46.2 million — the most in at least half a century — as 1

million more Americans went without health insurance and household incomes fell

sharply.

The poverty rate for all Americans rose in

2010 for the third consecutive year, matching the 15.1% figure in 1993 and

pushing many younger adults to double up or return to their parents' home to

avoid joining the ranks of the poor.

Taken together, the annual income and poverty

snapshot released Tuesday by the U.S. Census Bureau underscored how the

recession is casting a long shadow well after its official end in June 2009.

The number of poor children younger than 18

reached its highest level since 1962, said William Frey, a demographer at the

Brookings Institution.

Poverty reached a record high for Latino

children, who Frey said accounted for more than half the overall increase in

poor children last year.

Blacks had the highest child poverty rate at

39%, up more than 3 percentage points from last year.

Overall, poverty was generally higher than the

national rate in states with high unemployment and in the South. Mississippi

had the highest poverty rate last year, at 22.7%, and New Hampshire had the

lowest, 6.6%.

Overall, the number of 25- to 34-year-old men

and women who were living with their parents last spring totaled 5.9 million —

a 25.5% increase since the recession began in 2007.

The census report, coming shortly after

President Obama unveiled a proposed $447-billion package of tax cuts and

spending to revive job growth and the recovery, was seen as intensifying the

debate over the government's role in helping the poor and unemployed at a time

of budget deficits and painful cutbacks in public services.

JP Morgan Chief Says Bank Rules 'Anti-US'

America Should Pull Out of Basel - Because

they are Anti American

America is Out of Kyoto - Because they are

Anti America

America is Out of ICC - It is illegitimate

What suits to America is Americanism - What

suits to World and Principle of Justice is Anti America - This is what exactly

Americanism

EU-US Economies - Will Another Lehman-Style

Crisis Be Prevented? - CNBC

No it is not possible. The crisis cannot be

prevented. When we look at present situation not much has been changed and the

causes of the previous collapse are still existent in the market.

• Too

Big to Fail -- The companies which were affected and needs rescue have become

bigger, the systematic risk of collapse of the system has not removed or

reduced, over the years it has increased.

• Off

Balance Sheet Transaction - Derivatives and swaps are there and nobody really

knows how much each of them owe. How much risk or swaps or derivatives they

have played. Derivatives are still off balance sheet and not governed by the

Financial Authorities.

• Toxic

assets are still there on the balance sheet sitting and looking pretty beautiful.

No one knows how much toxic each of them has and what is its worth.

• Credit

Rating Agencies are same, methods are same and methodology is the same. They

are still beyond control and again started playing the dirty game.

• Auditors

are same - they have not changed their behavior and practices. They are not

controlled and supervised.

• Housing

is going down, mortgage is under water and bond for them are in market.

Corona Relief -The Governing Council decided

the following:

(1) To launch a new temporary asset purchase

programme of private and public sector securities to counter the serious risks

to the monetary policy transmission mechanism and the outlook for the euro area

posed by the outbreak and escalating diffusion of the coronavirus, COVID-19.

This new Pandemic Emergency Purchase Programme

(PEPP) will have an overall envelope of €750 billion. Purchases will be

conducted until the end of 2020 and will include all the asset categories

eligible under the existing asset purchase programme (APP).

A waiver of the eligibility requirements for

securities issued by the Greek government will be granted for purchases under

PEPP.

The Governing Council will terminate net asset

purchases under PEPP once it judges that the coronavirus Covid-19 crisis phase

is over, but in any case not before the end of the year.

The Governing Council of the ECB is committed

to playing its role in supporting all citizens of the euro area through this

extremely challenging time. To that end, the ECB will ensure that all sectors

of the economy can benefit from supportive financing conditions that enable

them to absorb this shock. This applies equally to families, firms, banks and

governments.

As central banks implement coronavirus rescue

plans, has moral hazard been forgotten?

One of the most important challenges facing a

central bank (CB) when it must act as a lender-of-last-resort to stabilize a

financial crisis is to avoid fostering moral hazard. This trap occurs when

market participants perceive little-to-no consequences for potentially

excessive risk taking, as they come to believe that they will be protected

should things go awry. Quick and decisive action by major CBs has stabilized

international financial markets during the pandemic downturn, setting the stage

for a broad economic recovery.

But coming on the heels of large-scale CB

accommodation during the 2008-2009 Global Financial Crisis (GFC), officials

have reinforced the market’s belief that CBs will time and time again take

policy measures to protect financial markets from widespread losses.

Having learned from the positive impacts of

their actions during the GFC, major central banks quickly jumped into action to

stabilize the situation when international financial markets plunged in March

as the COVID-19 pandemic struck. The US Federal Reserve (Fed) implemented huge

securities purchase programs, some without limits, going beyond US treasuries

and agencies to buy corporate bonds including those below investment grades

(which CBs traditionally do not touch).

The Fed also offered credit facilities to many

market players, including money market funds and corporations. Importantly, in

response to the US dollar funding crisis among non-US banks, the Fed arranged

currency swap lines with several major central banks and US Treasury repurchase

agreement lines with many other monetary authorities. As a result, the Fed

balance sheet quickly increased from $4.2 trillion in February to a peak of

$7.2 trillion in mid-June.

Similarly, the European Central Bank (ECB)

launched a €750 billion Pandemic Emergency Purchase Program, later increasing

it by another €600 billion. Under these programs, the ECB can purchase

government and corporate bonds in member countries, without previous

constraints on how much it can acquire in each member country. Consequently,

the ECB balance sheet has increased from €4.7 trillion in mid-April to €5.6

trillion in June.

Timely central bank actions have helped

international equity markets recover most of the 30 to 40 percent losses

suffered in February and March. Portfolio capital flows have more than reversed

their earlier net outflows from risk assets. Borrowers including those below

investment grades have been able to issue significant volumes of bonds. For

example, global corporations have issued more than $6.4 trillion of bonds—on

course to reach a record high this year. Emerging market sovereigns have also

issued $123.5 billion of hard currency bonds in the first half of the year.

But the swift recovery of financial markets

seems to be at odds with the underlying economic reality—where unemployment

remains widespread and bankruptcies remain quite elevated. Moreover, financial

market buoyancy is persisting even as the Fed balance sheet has shrunk from

$7.2 trillion to $6.9 trillion in late July; and the ECB balance sheet has also

declined modestly in recent weeks—reflecting investors’ reduced reliance on CB

support. This is a clear indication of moral hazard at work. Markets no longer

need central banks to add liquidity to do well; all they require is just the

conviction that CBs are there ready to provide support when needed. While

providing breathing room in the short term, this expectation of CBs coming to

the rescue will likely lead to continued risk taking by the market, which could

threaten future financial bubbles and stability risks.

Another manifestation of moral hazard is the

fact that plentiful CB liquidity and low interest rates continue to sustain

most companies, including unproductive ones. The number of zombie

companies—those generating insufficient profits to pay interests on their debt—

has noticeably risen as a share of the corporate universe. According to

Deutsche Bank Securities, zombies currently make up 20 percent of US companies,

having doubled since 2013. The share of zombies in Europe is likely similar

given that in 2016, a BIS study estimated the zombie share at 12 percent for

fourteen advanced economies under study (mostly in Europe). The United States

and Europe could be falling into the same trap Japan did three decades ago,

when the country kept zombie companies alive with easy financing conditions so

that their share reached almost 35 percent in the mid-1990s, ushering in

decades of slow growth.

Federal

Reserve's $3 trillion virus rescue inflates market bubbles

The

Federal Reserve’s $3 trillion bid to stave off an economic crisis in the wake

of the coronavirus outbreak is fuelling excesses across U.S. capital markets.

The

U.S. central bank has pledged unlimited financial asset purchases to sustain

market liquidity, increasing its balance sheet from $4.2 trillion in February

to $7 trillion today.

While

the vast majority of these purchases have been limited to U.S. Treasuries and

mortgage-backed securities, the Fed’s pledge to bolster the corporate bond

market has been enough to spur a frenzy among investors for bonds and stocks.